irs tax levy program

Submit Form 9423 to the Collection office involved in the lien levy or seizure action. Solution to resolve your tax problem.

Notice Cp504b What It Means How To Respond Paladini Law

For individual taxpayers receiving notices letters about a.

. Ad Compare the Best Tax Relief Companies to Help You Get Out of Tax Debt. Review Comes With No Obligation. Ad Remove IRS State Tax Levies.

Ad Avoid Bogus Review Sites And Scams. 28 Yrs Exp CPA MS Tax Ex-IRS Agent. See if you Qualify for IRS Fresh Start Request Online.

Ad Avoid Bogus Review Sites And Scams. Start Your Free Trial IRS Levy Relief Help Here Today. Social Security Benefits Eligible for the Federal Payment Levy Program.

Delinquent Return Filings - The IRS will not default an OIC for those taxpayers who are delinquent in filing their tax return for tax year 2018. The Federal Payment Levy Program is an automated levy program the IRS has implemented with the Department of the Treasury Bureau of the Fiscal Service since 2000. In last weeks blog I described the Federal Payment Levy Program FPLP and outlined my general concerns about the IRSs implementation of the Low Income Filter LIF.

Ad Owe back tax 10K-200K. Trusted Reliable Experts. Ad Use our tax forgiveness calculator to estimate potential relief available.

End Your IRS Tax Problems Today. Beginning in February 2002 Social Security benefits paid under Title II - Federal Old-Age Survivors and Disability. In July 2000 the IRS in conjunction with the Department of the Treasury Bureau of Fiscal Service BFS started the Federal Payment Levy Program FPLP which is authorized by Internal.

Ad End Your IRS Tax Problems. 28 Yrs Exp CPA MS Tax Ex-IRS Agent. The Federal Payment Levy Program FPLP is an automated levy program the IRS has implemented with the Department of the Treasury Bureau of the Fiscal Service BFS since.

BBB Accredited A Rating - Free Consult. Get Your Free Tax Review. It can garnish wages take money in your bank or other financial account seize and sell your vehicle.

Call The Nations Most Experienced IRS Levy Expert. However taxpayers should file any. No Fee Unless We Can Help.

Owe IRS 10K-110K Back Taxes Check Eligibility. Start Your Free Trial IRS Levy Relief Help Here Today. In situations where the IRS actions are creating an economic.

Call The Nations Most Experienced IRS Levy Expert. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. Click Now Find the Best Company for You.

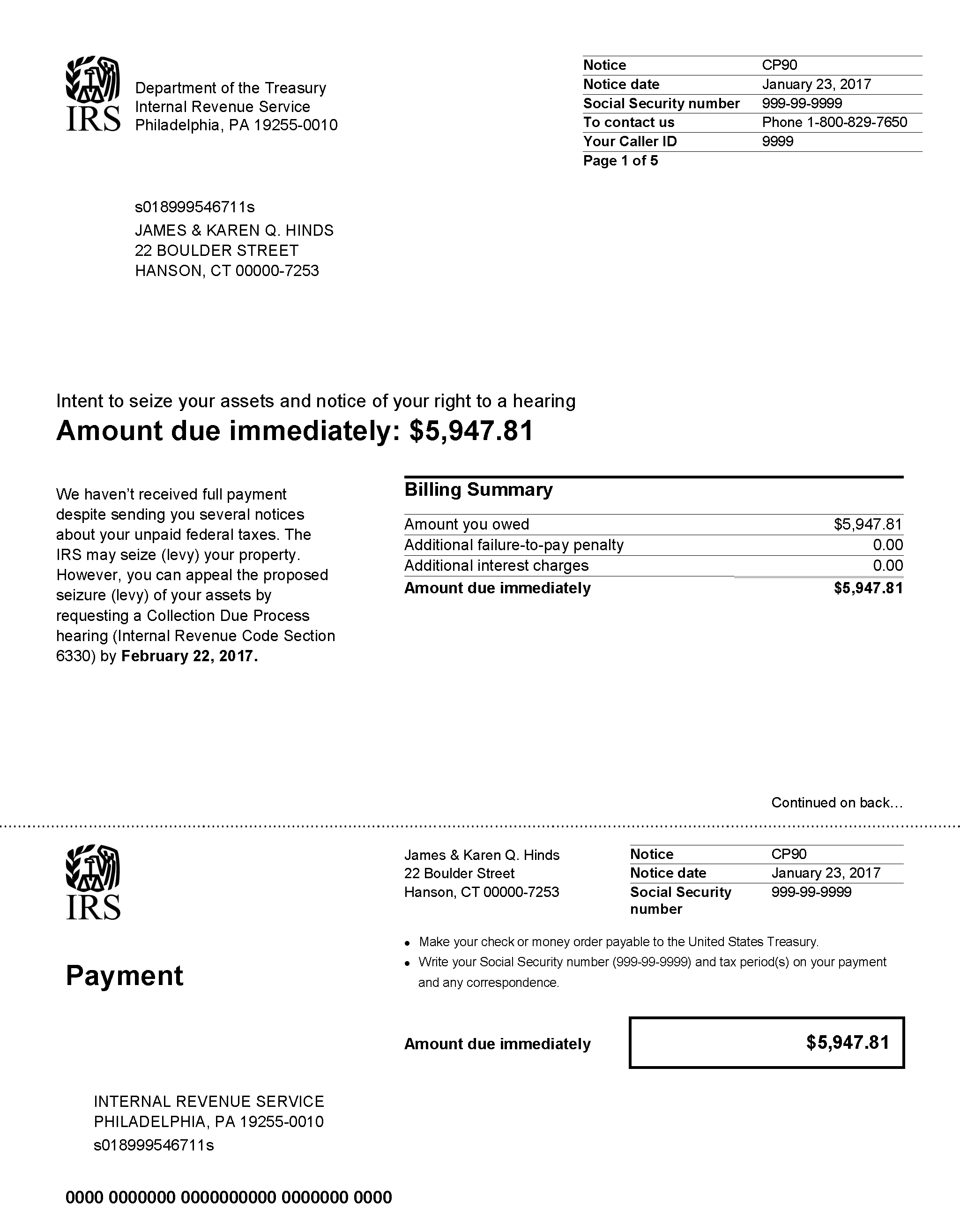

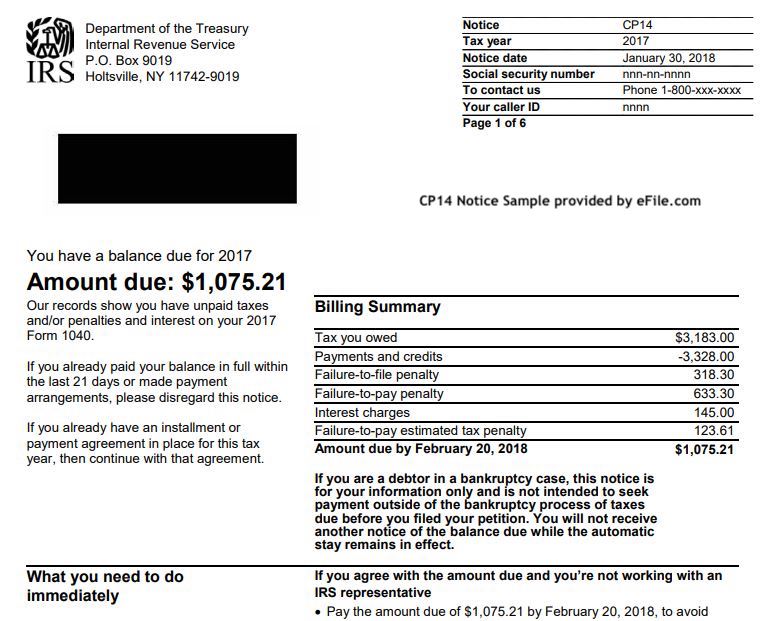

An IRS levy permits the legal seizure of your property to satisfy a tax debt. The Federal Payment Levy Program FPLP is an automated system the IRS uses to match its records against those of the governments Bureau of the Fiscal Service BFS to identify. Levy proceeds will be applied to your federal tax liability.

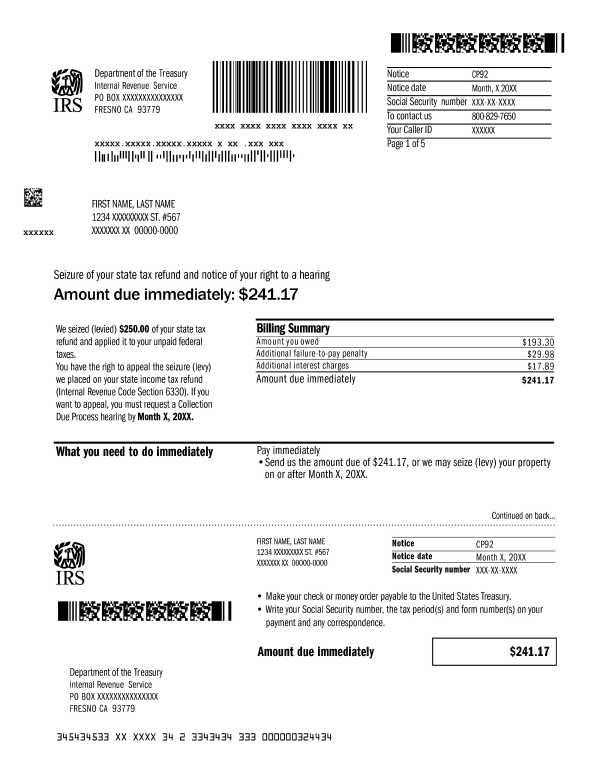

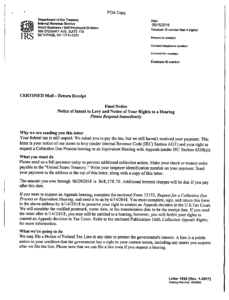

Prior to the levy the IRS will have issued a notice of intent to levy and notice of your right to a hearing about the levy. The IRS can also use the Federal Payment Levy Program FPLP to levy continuously on certain federal payments you receive such as Social Security benefits. First time abatement relief is also available for the first time a taxpayer is subject to one or more of these tax penalties.

The Federal Payment Levy Program FPLP is an automated levy program the IRS has implemented with the Department of the Treasury Bureau of the Fiscal Service BFS.

5 11 7 Automated Levy Programs Internal Revenue Service

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Cp 508c Notice Of Certification Of Your Seriously Delinquent Federal Tax Debt To The State Department

Tax Levy Understanding The Tax Levy A 15 Minute Guide

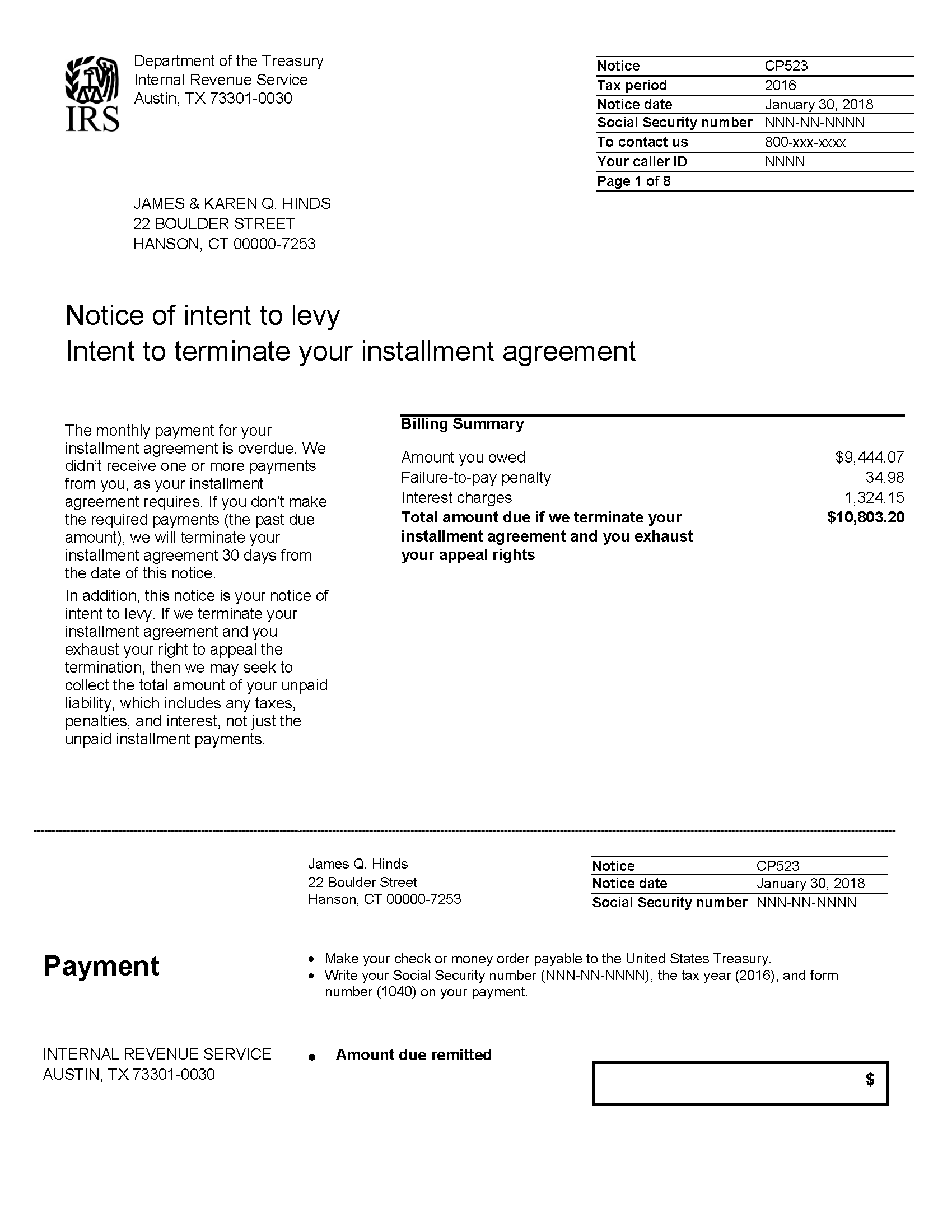

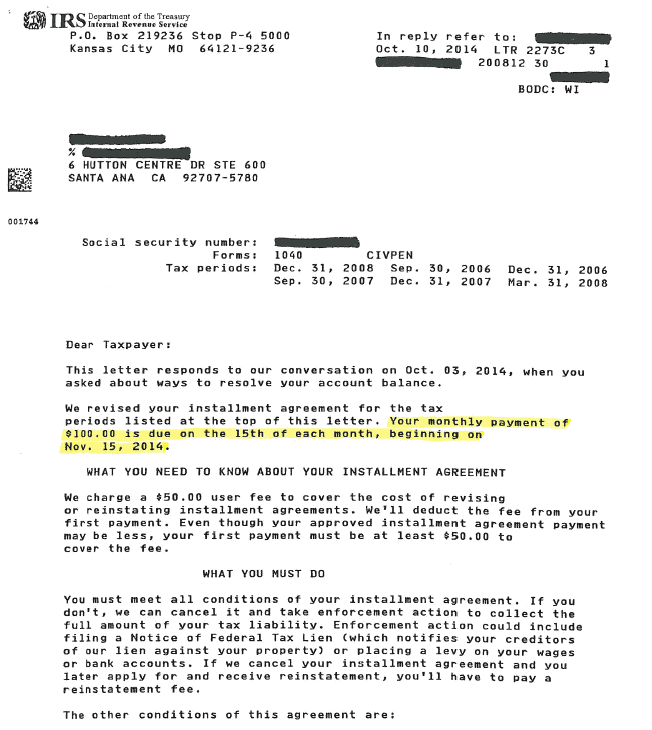

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

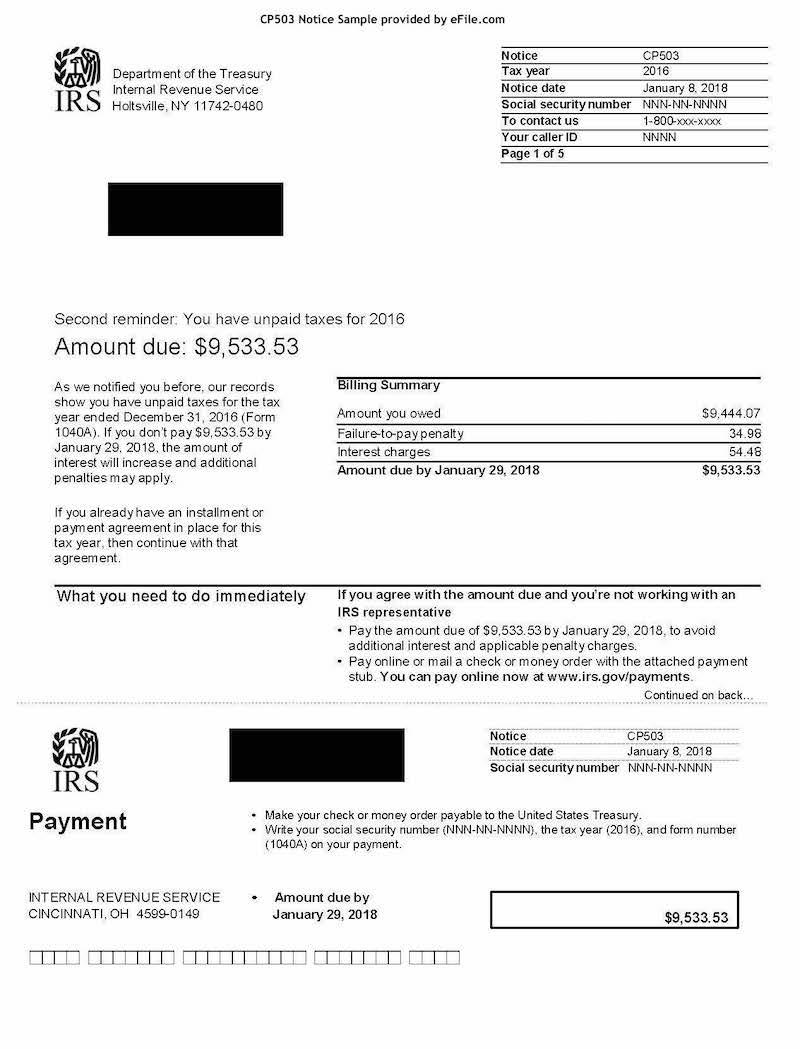

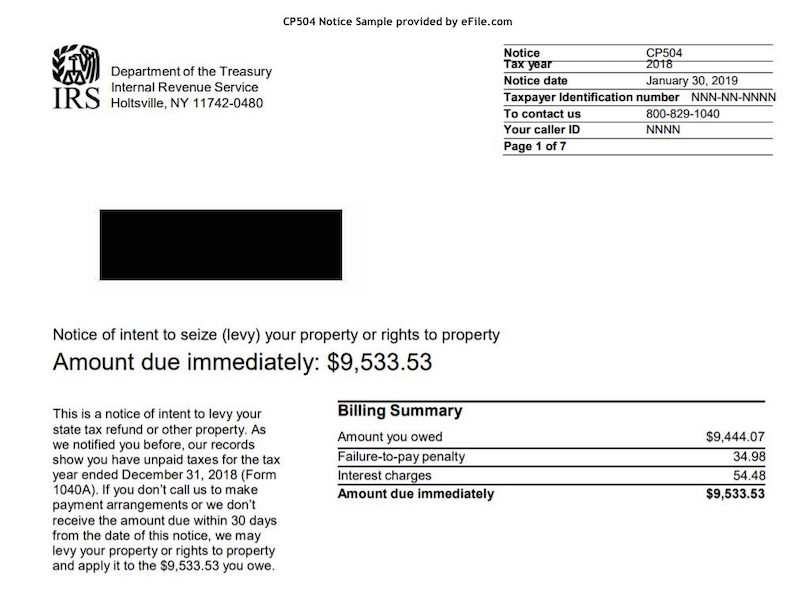

Irs Audit Letter Cp504 Sample 1

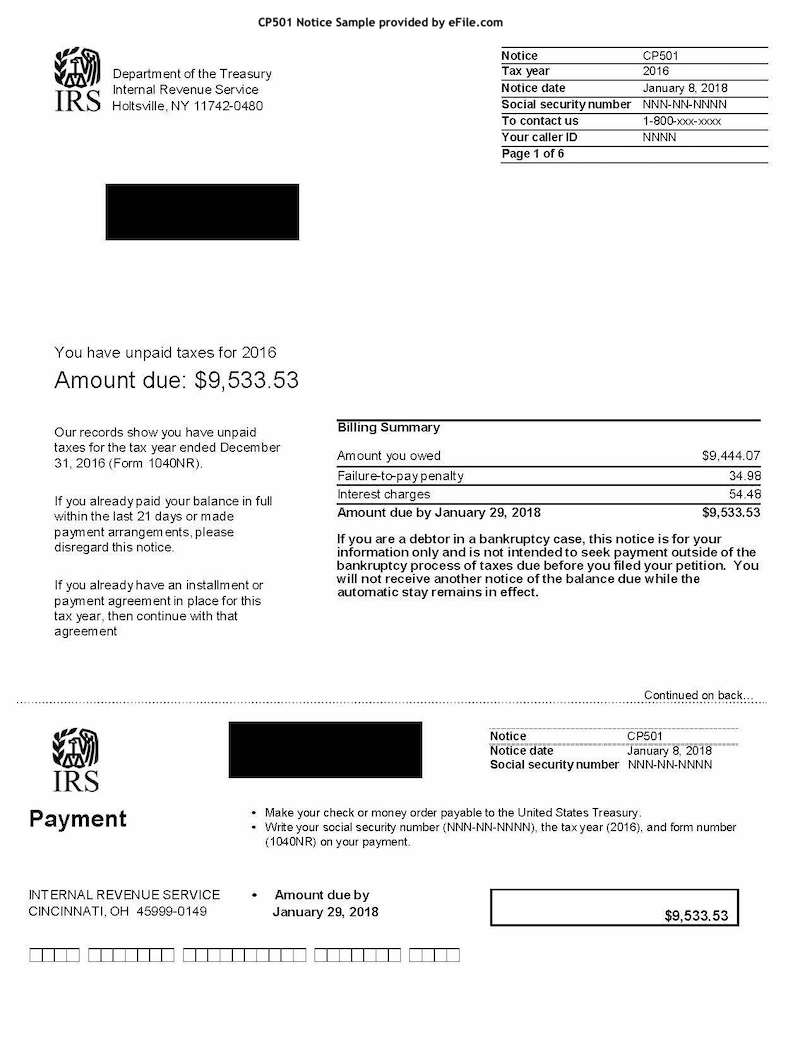

Irs Tax Letters Explained Landmark Tax Group

Irs Cp134r Federal Tax Deposit Ftd Refund

5 19 9 Automated Levy Programs Internal Revenue Service

Irs Cp504 Notice Of Intent To Levy What You Should Do

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Just Sent Me A Notice Of Intent To Levy Intent To Terminate Your Installment Agreement Cp 523 What Should I Do Legacy Tax Resolution Services

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

How To Avoid The Dreaded Federal Payment Levy Program

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Tax Levy Tax Law Offices Of David W Klasing

Irs Letter 1058 Or Lt11 Final Notice Of Intent To Levy H R Block